The Best Investment Strategy

Stocks vs Real Estate Investment

After recent increases in mortgage interest rates and a period of volatile stock market movement we were curious as to how the returns would compare on an investment of $50,000 in the stocks versus investing the same amount of cash in residential real estate.

A 10-year return on the S&P 500 index is a good barometer for stock market investment.

So we compared this type of investment to investment in 1-to-4 family residential real estate and we chose what we thought would be an ideal investment amount for this form of real estate in a large Texas metropolitan area.

Cash of $50,000 would enable an investor to purchase $188,000 property with a 25% down-payment of $47,000. The real estate investment would require another $3,000 in acquisition closing costs for a total cash outlay of $50,000. This is amount we used as the cash investment in our comparison.

Since the tax implications on our investment strategies vary significantly between the stock market and real estate investment strategies we computed the after-tax return for both investments. We estimated income tax based on an income tax rate of 25% which was applied to taxable income on the real estate investment and dividend distributions on the stock market investment. Capital gains tax on the sale of both the stock and the real estate was based on a 15% capital gains tax rate.

These are the most likely tax brackets for most investors that invest this amount of cash.

Assumptions

We made the following assumptions based on economic conditions at the time of publication:

Stock Investment Assumptions

Amount Invested: $50,000

S&P 500 Index

10-year nominal return with reinvested dividends

1 Jan 2014 through 31 Dec 2023

207.72% - roughly 12% annualized

Investment Value after 10-years: $153,862

Real Estate Investment Assumptions

Price / Value: $188,000

25% down-payment of $47,000

75% LTV for a $131,000 original loan amount

30-year fixed-rate mortgage at 7.000% per annum

Economic Assumptions

Value Appreciation: 4% per annum, compounded

Rent Appreciation: 4% per annum, compounded

Expense, Repairs and Improvements Inflation: 4% annually, compounded

Tax Assumptions

Effective income tax rate: 25% - Effective capital gains rate: 15%

Results of the Stock Investment

We calculated the nominal return with reinvestment of dividends on a $50,000 investment in the S&P 500 index using an online S&P returns calculator for the period beginning 1 January 2014 and ending 31 December 2023.

That investment would have an ending value of $153,862 evidencing a gain of $103,862 over and above our original $50,000 investment prior to deduction for taxes paid.

Only the ending value of the reinvested dividends was indicated by the calculator. We estimated the total dividend distributions for the 10-year period to be $15,986 using a source that provided annual dividend rates for the S&P 500. The estimated income taxes on these dividend distributions was $3,996.64 based on a 25% effective income tax rate. Capital gains tax was $15,579.29 based on the 15%. After deducting those two taxes from our gain, the after-tax total return was $84,285.99.

Summary

Less Original Investment: $50,000

Less Income Tax paid on Dividends: $3,997

Less Capital Tax on sale of Stock: $15,579

Net After-tax Total Return: $84,286

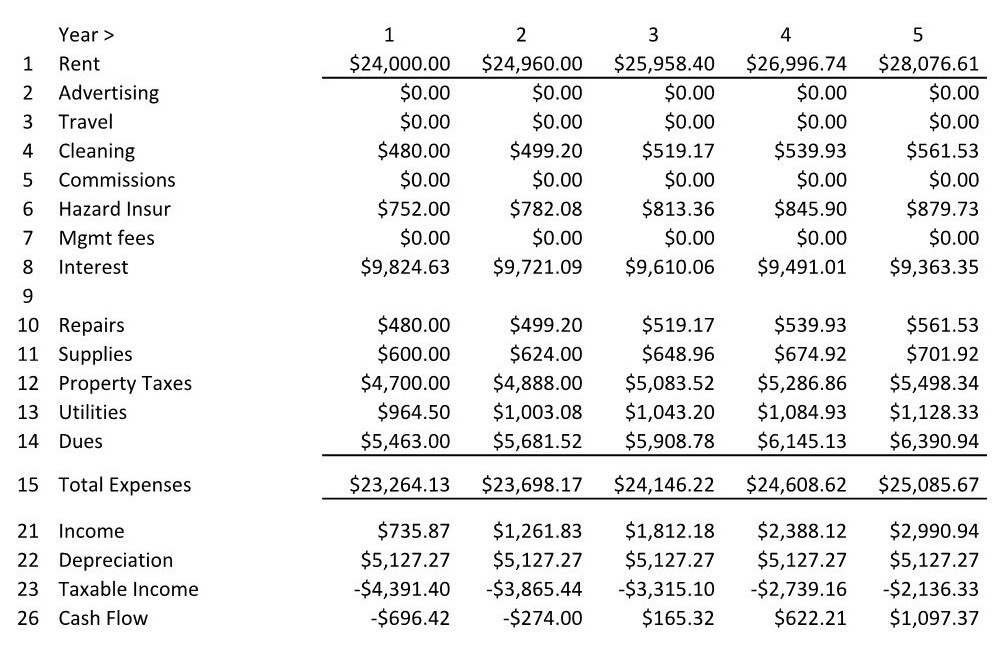

Results of the Real Estate Investment

As indicated, we looked at the purchase of a property for $188,000, with a down-payment of $47,000 (25% down) utilizing a 30-year mortgage with an original loan amount of $141,000 bearing interest at the rate of 7.000% per annum. This was a realistic rate for an investor loan at a 75% LTV ratio for investors with excellent credit at the time of publication in April of 2024. We assumed $3,000 in buyer-paid closing costs at the time of property acquisition bringing the total cash outlay to $50,000.

Further assumptions related to inflation are shown above. We assumed reinvestment of positive cash-flow at the same rate of return as our stock market rate of return in the stock market analysis above. For this comparison we assumed active management of the property by the investor without paying management fees.

At the end of the 10-year period, the estimated value of the property was $278,286, the balance on our fixed-rate loan was $120,996 resulting in Equity (value less loan balance) of $157,290. Additionally, positive cash-flow over the 10-year period from rental income totaled $24,669. Income from reinvested cash-flow over the 10-year period totaled $563. We deducted estimated costs associated with the sale of the property at 7% of the value totaling $19,480. And income and capital taxes totaling $19,621. The resulting after-tax net return was $91,677.

Summary of Real Estate Investment

Less Loan Balance (payoff): $120,996

Subtotal (Equity): $157,290

plus Cumulative Cash-flow from Rents: $24,669

plus Dividends earned on Reinvested Cash-flow: $563

less Income Tax paid on Reinvested Cash-flow: $141

less Capital Gains Tax on Sale of the Property: $19,480

Net After-Tax Return: $91,667

Details of Rental Income by Year

The Comparison

Comparing the two investments, the real estate investment resulted in a positive increase in investment capital of $91,667 compared to $82,634 on the stock market investment

Important Considerations

The return is not the only relevant factor when considering the two investment strategies.

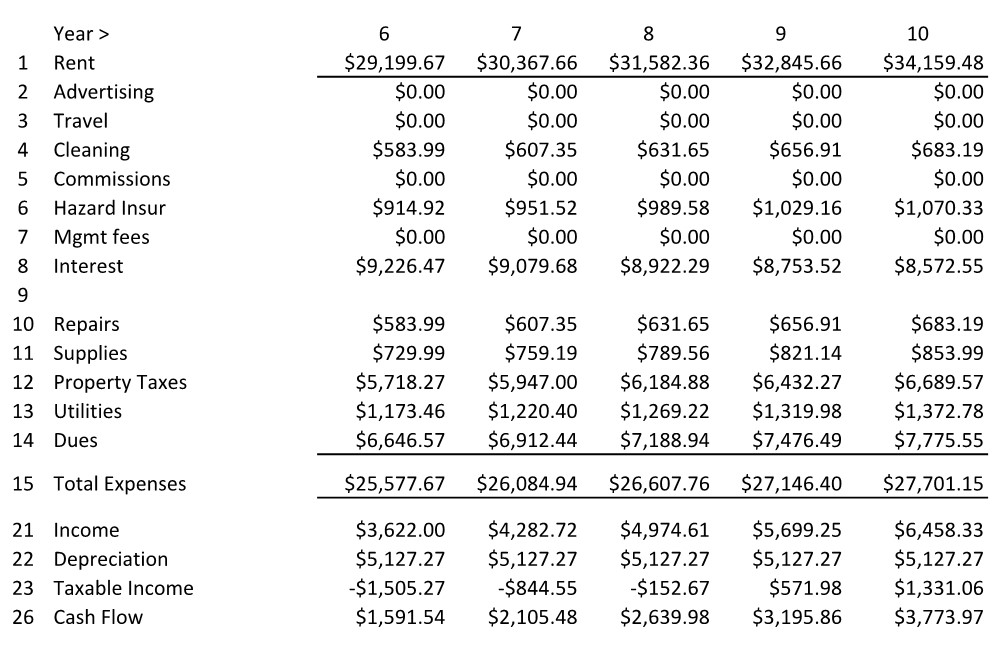

Risk

As the following chart on the movement of the S&P 500 over time indicates, stocks are volatile. The S&P 500 can be up 30% in one year and 30% down in the following resulting in significant variances in returns depending on the date the investment is initiated and the date the assets are sold. If circumstances required the liquidation of all or a portion of the stocks during a year when the S&P 500 was significantly down rather than at the conclusion of a year with significant growth the 10-year rate of return we used would significantly change the overall return on the investment.

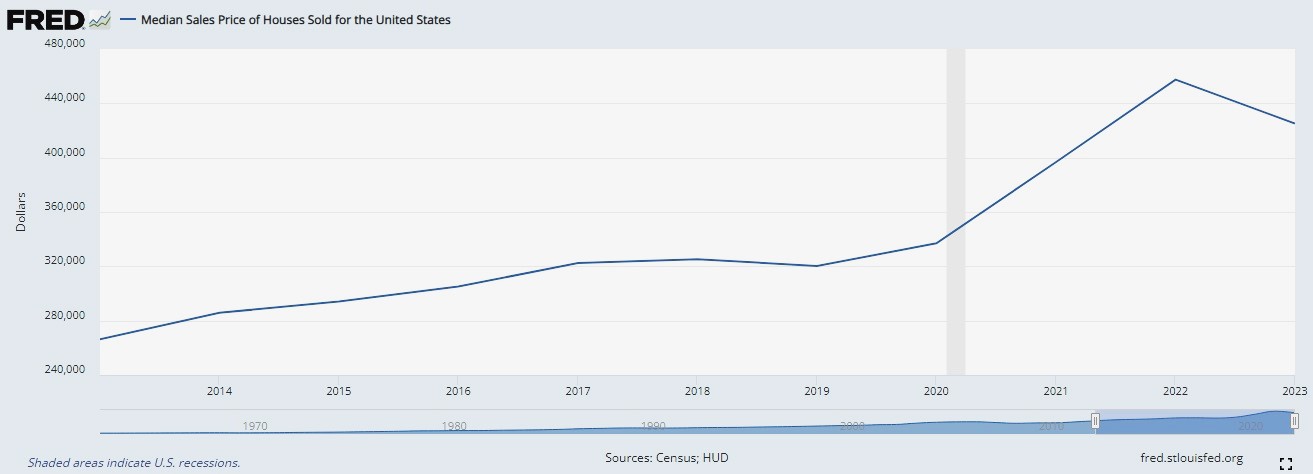

The value of real estate is, on the other hand, extremely consistent. During the past 20 years real estate experienced a fairly constant appreciation in value year over year consistent with the 4% appreciation rate we used in this particular comparison. Although there was a decline in real estate values in 2023, this was merely an adjustment of the overvaluation during 2021 and 2022, when prices increased approximately 15% in both years. The 3-year average from 2021 through 2023, that includes the 2023 decline, was well above 8%, double the 4% appreciation rate we used in the example. Clearly, real estate is a reliably consistent long-term investment.

Active versus Passive Investments

Another consideration is the fact that investment in the stock market is almost an entirely passive investment, requiring no active participation by the investor. Residential real estate investment of the type we are describing has varying investor participation activity depending on the extent to which the investor is able and willing to invest some amount of time in connection with the investment. Our comparison assumed that the investor would manage the property, avoiding the necessity of paying management fees which would affect the overall investment. This more active form of investment is perfectly suited to a married couple where at least one of the spouses does not have employment requiring a 9-to-5 commitment or to at-home employees afforded a certain degree of independence choosing their work schedule. This type of investor can easily devote the five or so hours per month that managing a property might require.

Interest Rates

At the time of comparison, mortgage interest rates were at the highest level they had been in decades. Despite this, the property still generated income and appreciation that significantly exceeded the stock investment. With a 5% interest rate, rather than the 7% rate we used for this comparison, the net return increases from about $90,000 over 10 years to more than $140,000. That’s more than a 50% increase in the overall return. And for those prudent or lucky investors that acquired a 3% fixed-rate mortgage, as I did in December of 2019, the net return would be $184,000, more than double the return generated with a mortgage rate of 7% per annum.

Based on these interest rate considerations you might conclude that delaying the purchase of real-estate to a time when interest rates are not at a multi-decade high would make sense. But since our comparison that is based on these historically high rates of interest still generates a higher return than the stock market investment, your delay would only result in lowering your investment returns while waiting for mortgage rates to decline. Wouldn’t it be more prudent to invest now after the 2023 decline in home prices and then refinance to a lower rate two to three years from now to further increase the return on the investment?

The Bottom Line

Ultimately, the data supports the conclusion that investment in residential real estate, for any investor willing to dedicate a nominal amount of time to property management, is now, and will be, a superior long-term investment when compared to investment in blue-chip stocks.

Questions? Give us a ring!

(Click a number to dial on your device)